Market leaders in Gold Investment

Invest in Gold Coins

We exclusively stock investment-grade bullion of the highest quality and above 90 purity and thereby exempt from VAT in the UK.

AS SEEN IN…

Download our Guide to Tax-Free Gold

Complete this short form to immediately receive your copy - for free.

We are fully GDPR compliant and your data will be kept safe.

A Comprehensive Insight to Gold Capital

Investment-Grade Bullion

3 ways to invest in physical gold bullion

We only have in stock investment-grade bullion that is of the highest purity (above 90) and hence exempt from UK VAT.

Bullion Gold Bars

Suitable for gold buyers wishing to buy huge quantities. Gold bars are more convenient to store but offer less flexibility and more illiquidity than gold coins. Private mints manufacture gold bars. They are not considered legal currency and as such are liable to CGT.

Certified Gold Coins

Uncertified gold coins are almost never worth more than certified gold coins. Since there is no assurance of grade, condition, or authenticity, uncertified coins involve some risk. All of the gold coins we provide are made by a sovereign government’s mint and have the status of being accepted as legal money. Gold coins are therefore exempt from both VAT and CGT.

Gold Coins

Perfect for investors who want to sell the majority or a portion of their holdings in the next to mid-term. Gold coins often provide much greater purchase flexibility and liquidity when compared to gold bars. Each and every one of the gold coins that we provide is produced by a sovereign government’s mint, presenting the circumstance in an appropriate manner. Hence, gold coins are exempt from both CGT and VAT.

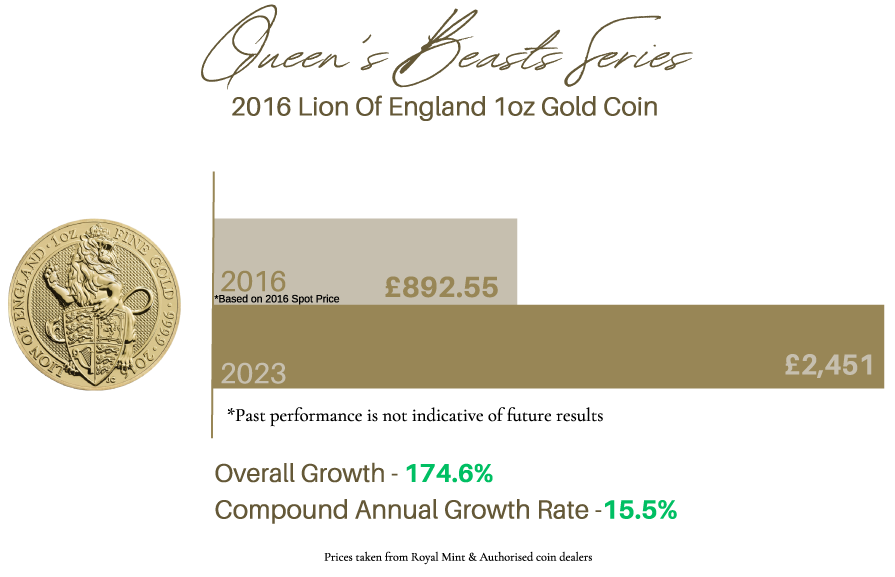

Historical Growth

*Based on 2016 Spot Price (https://goldprice.org/)

Gold Capital

Gold is regarded as the ultimate-performing asset of the twenty-first century

Historically, gold has been proven to outperform traditional asset-classes and acts as a powerful hedge against inflation.

Hello Stability

Why is Gold the ultimate investment

Simple Process

The buying process

Start your investment today

Download our Guide to Tax-Free Gold

Complete this short form to immediately receive your copy - for free.

Read our investment guide for everything you need to know for investing in Gold.

Within this complimentary guide, you’ll learn:

✓ About Gold Capital

✓ Certified Coins

✓ Loose Coins

✓ Gold Bars

✓ Reasons to buy (Why Choose Gold?)

✓ Benefits of investing in Gold & Silver

✓ How To Start Investing – The Buying process

✓ Supply & Demand

✓ Gold vs Other Assets

✓ Gold Performance & Tax

✓ Client testimonials

✓ FAQs

Market Leaders

We Work With Only Trusted Partners

Frequently Asked Questions

What is the meaning of “Bullion”?

Bullion is gold and silver that is officially recognised as being at least 99.5 and 99.9 pure and is in the form of bars, ingots, and coins.

Is Gold bullion subject to VAT?

As of the 1st of January 2000, investment gold is NOT subject to VAT throughout the EU. This includes all gold bullion bars and coins purchased in the UK and EU.

Why is your gold price above the current spot price?

The additional price for acquiring physical bullion products above the current spot price is due to the costs associated with minting, manufacturing, and refining along with brokerage fees, transportation, Insurance, or storage.

Are bullion coins exempt from CGT?

Capital gains tax is exempt on all British legal currency. Any coin produced by The Royal Mint with a face value will benefit from being CGT-free.

Why should I purchase “Graded” coins?

Graded coins are protected and sealed in a tamper-proof casing which retains their certified grade and guarantees authenticity. In almost every case a graded coin is of higher value than ungraded.

Gold Capital solely supplies certified coins by the PCGS or NGC as they are among the top tier of a 3-tier grading service.

What is the delivery process?

Gold Capital will update you on the delivery date and supply you with a unique tracking number. All orders are fully insured for your peace of mind.

You must be 18 or over to order with Gold Capital

1. Gold Capital website, guide or marketing materials solely offer information about investing and saving with a precious metals influence. Gold Capital do not offer any opportunity to participate in options, derivatives, futures or any security.

2. Instead Gold Capital can only assist in physical metal (gold / silver – coins and bars) for delivery or storage. As such If you’re unsure of the suitability of an investment or purchase based on your circumstances please seek independent advice.

3. The market rate for gold / silver can go down as well as up.

4. Statements made in our guide, website or marketing materials merely reflect honestly held opinions or third party references.

5. Gold Capital cannot guarantee that the information provided is 100 accurate and error free, and we provide no warranty as to the accuracy of the statements and information provided.

6. Precious metals and coins are not specifed investments under the Financial Services and Markets Act 2000 (‘FSMA’) and Gold Capital is not regulated by the Financial Conduct Authority.